Subscribe to Our Newsletter

Stay updated with the latest tips and strategies. Get additional discounts and alerts on offers.

Are you trying to secure funds for your startup or project but struggling to find the right investors? A targeted email list of US investors could be your key to success. However, finding one for free isn’t always easy.

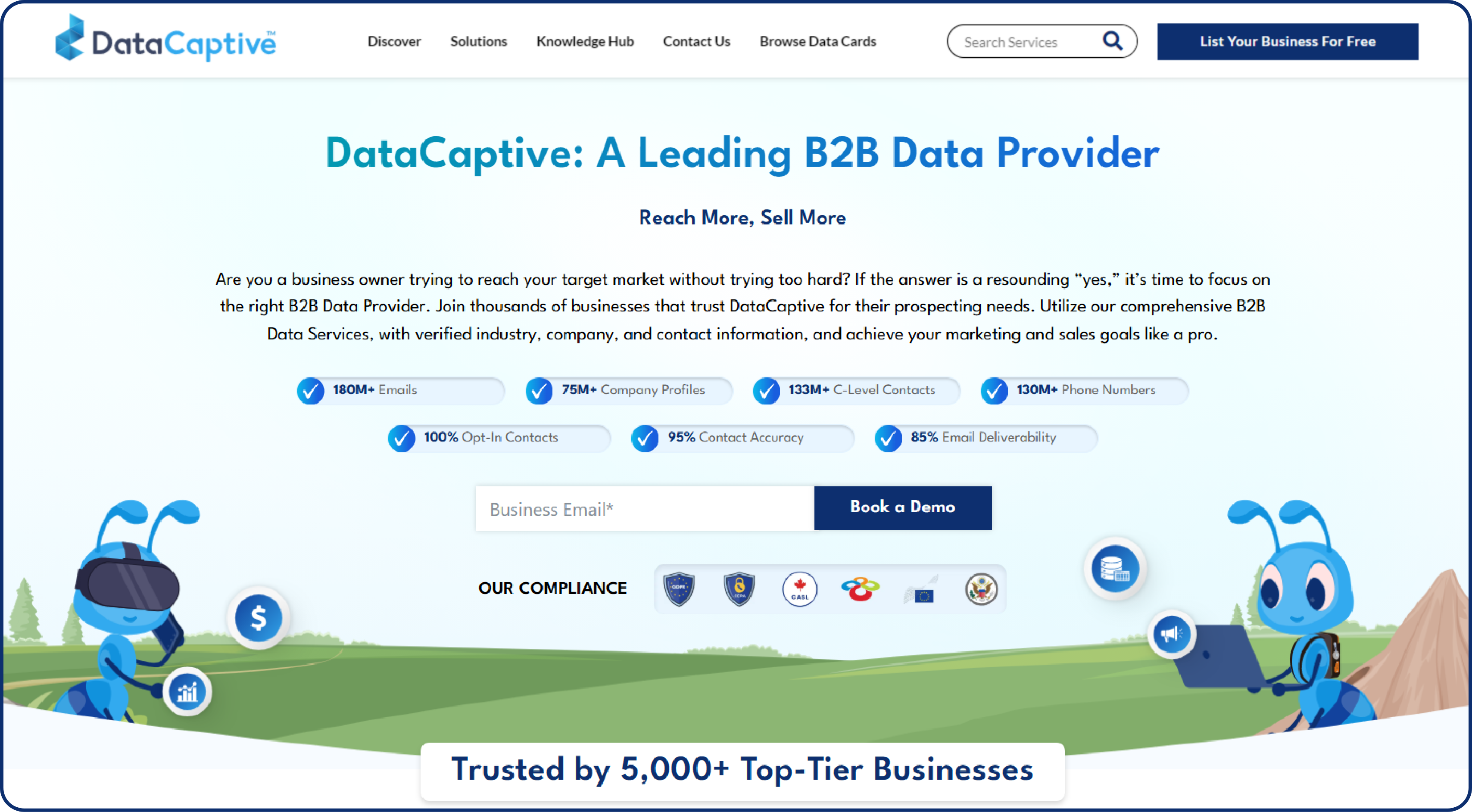

In this guide, we’ll explore smart strategies to help you build or locate a US investors’ email list at no cost. Additionally, we’ll show you how premium options such as DataCaptive can significantly enhance your investor outreach, offering verified and reliable contact information to boost your chances of success.

Before we dive in further, let’s understand why having a targeted list of US investors is crucial. Here are the major reasons:

Get a Free Investors Email List Now!

While there are many paid tools and platforms that provide access to investor contact lists, several free methods too can help you gather valuable leads. Here are some effective strategies to obtain free email lists of investors:

LinkedIn is a powerful networking tool, especially in the business and investment community. Here’s how you can use it to get free lists:

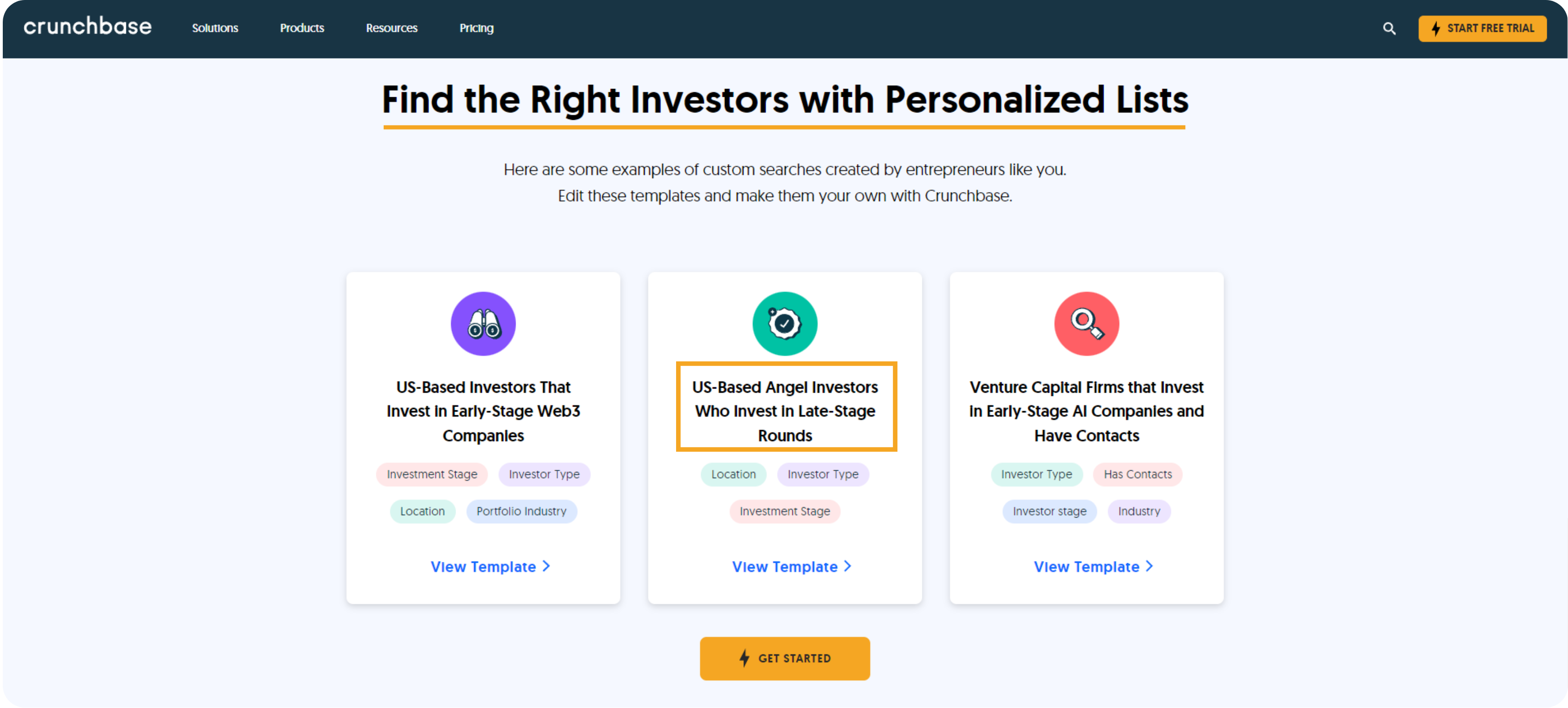

Investment platforms such as AngelList and Crunchbase can be invaluable resources for finding potential investors. Here’s a lowdown on these two platforms:

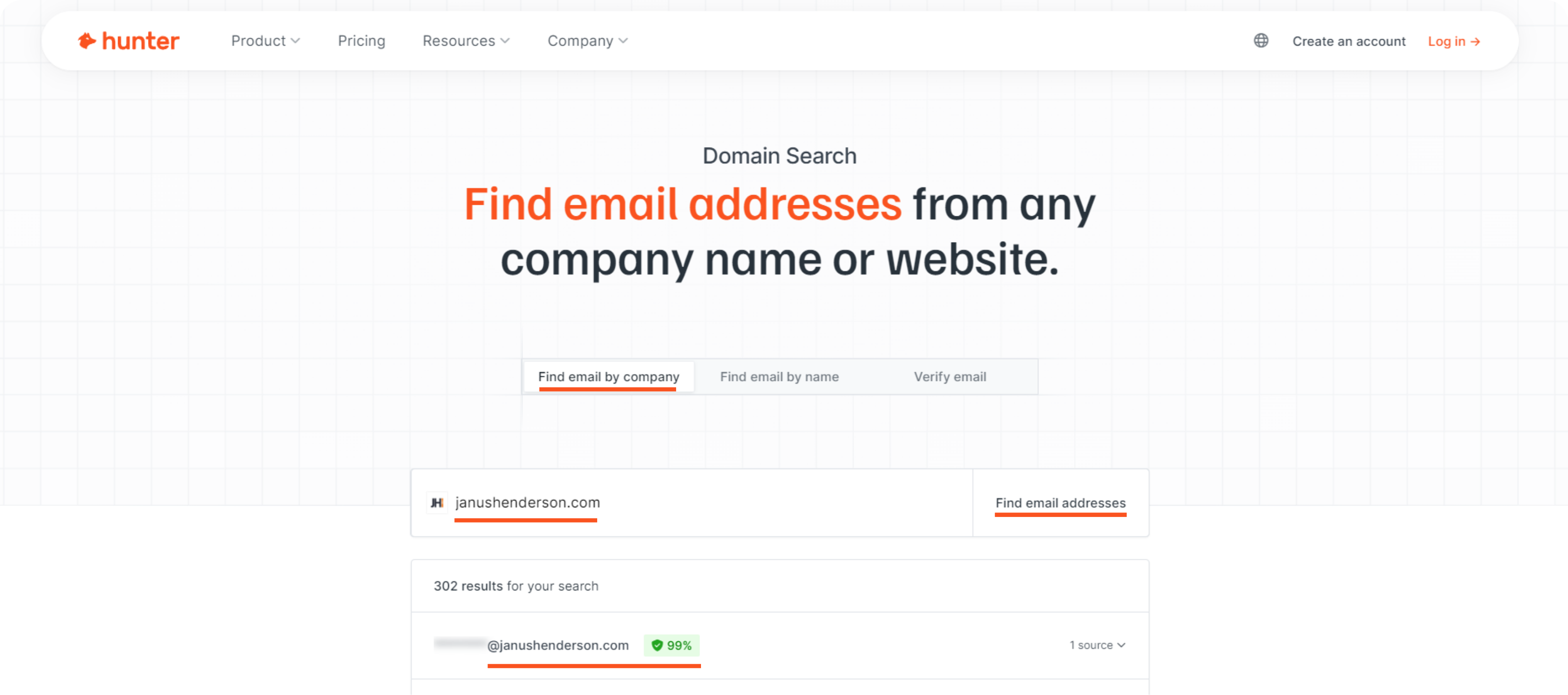

There are several free email lookup tools available online. These tools allow you to search for the email addresses of potential investors by entering their names and company domains. Here are the details of two such tools:

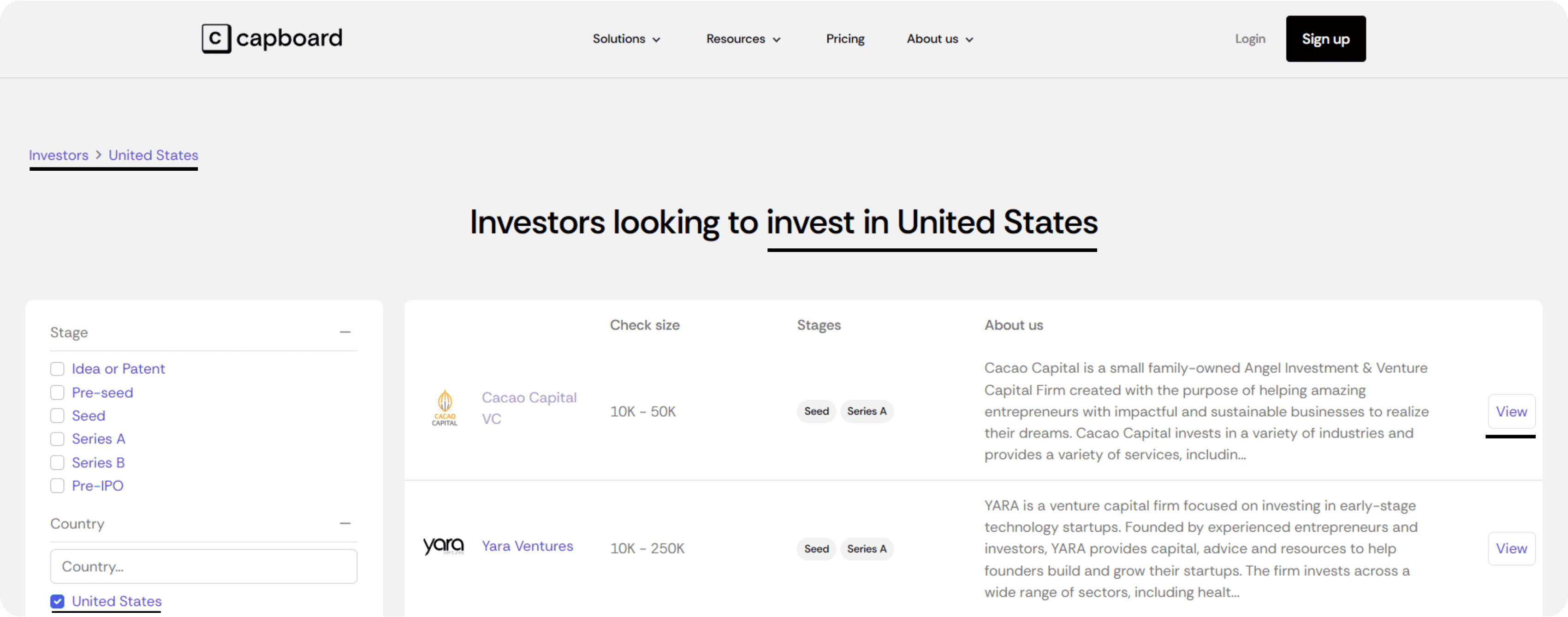

Several organizations and websites provide free access to databases and lists of investors. Here are a few such options:

Participating in events, webinars, and online forums focused on entrepreneurship and investments is an excellent way to connect with investors. Here are some options you can try:

While finding a US investors email list for free is possible, using a premium service can streamline the process significantly and save time. One such recommended avenue is DataCaptive.

Wondering why you should choose DataCaptive for your investors’ email lists? Here are some major advantages of using DataCaptive:

It’s time to obtain a personalized US investors email list from DataCaptive!

We hope you now know how to get investors for free. Finding a US investor email list for free can be a challenging but rewarding endeavor. You can build a valuable list of contacts by leveraging LinkedIn, investment platforms, email lookup tools, public databases, and networking events.

However, for those who want a more streamlined and efficient approach, using a trusted platform such as DataCaptive can be a game-changer. With DataCaptive, you gain access to a highly accurate, customizable, and legally compliant database of investors, giving your outreach campaigns a significant boost.

So, whether you’re a startup founder or an entrepreneur looking to expand your network, this guide provides the roadmap you need to find US investors and take your venture to the next level.

Acquire your free sample list of investors’ emails today from DataCaptive!

Yes, it is possible to find a free investor email list by leveraging LinkedIn, exploring investment platforms (e.g., AngelList, Crunchbase, etc.), utilizing free email lookup tools (e.g., Hunter.io, Clearbit Connect, etc.), and accessing public databases. These methods require time and effort but can yield valuable contacts without any payment.

Some of the best tools to find investors’ emails include LinkedIn (in-built tools such as Sales Navigator); email lookup tools such as Hunter.io, FindThatLead, and Clearbit Connect; and databases and platforms such as AngelList and Crunchbase. These tools and platforms help you locate relevant contact information and build targeted email lists.

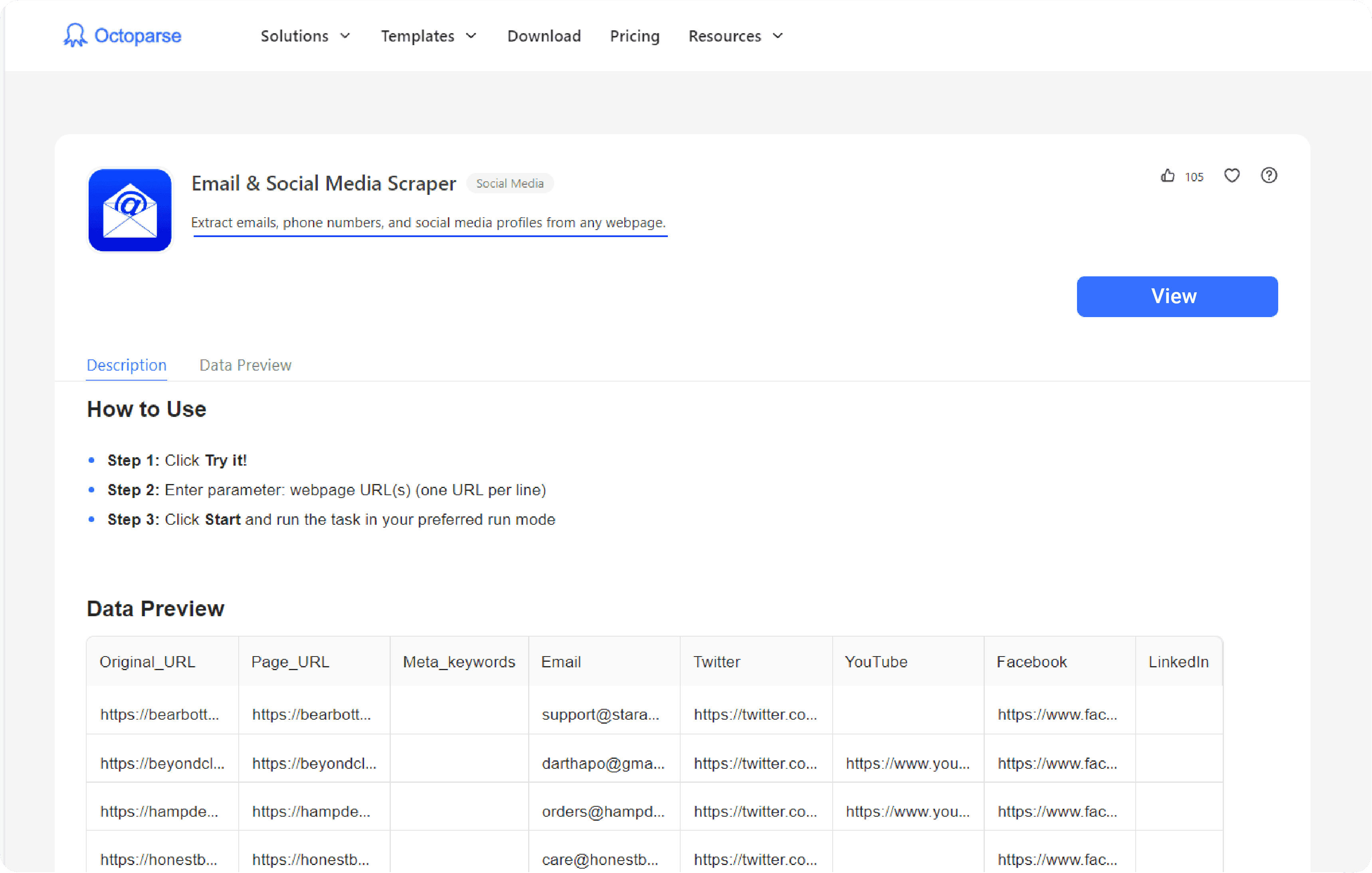

The legality of email scraping tools depends on how they are used. Scraping publicly available information is generally legal. However, using these tools to collect data from private or restricted sources can violate privacy laws. It is essential to ensure compliance with local regulations and the policies of the websites and online sources you are scraping.

Using a premium service such as DataCaptive provides several advantages, including access to a comprehensive, accurate, and up-to-date database of investors. DataCaptive offers customization options to target specific industries or investment criteria, saving time and increasing the effectiveness of your outreach campaigns. Additionally, their data is legally compliant and verified, which reduces the risk of errors and improves ROI.

Yes, many premium tools and platforms such as LinkedIn Sales Navigator, DataCaptive, and PitchBook offer free trials, allowing you to explore their features and services. These trials provide temporary access to premium databases and filters, helping you decide if the tool meets your needs, before you make a purchase.

Once you have a list of investor emails, the next step is to build meaningful relationships. Start by crafting personalized and compelling email pitches that clearly communicate your business idea, value proposition, and funding requirements. Follow up with additional information, updates, or invitations to webinars and meetings. Maintaining regular, thoughtful communication is key to building trust and interest.

Yes, you can. The best bet is to use LinkedIn’s Sales Navigator tool. Once you have the contact information you require, you can follow up with your prospects and offer your products or services as the solutions for their pain points.

Using free methods for gathering contact data can come with certain risks, such as outdated or inaccurate email addresses. Additionally, without verification, your outreach may have high bounce rates or even lead to your emails being marked as spam. To mitigate these risks, always verify emails before sending out campaigns and use reputable tools and platforms.

When emailing investors, keep your message concise and personalized. Highlight your startup’s unique value proposition and traction, explaining why it aligns with the investor’s interests. Use a clear and engaging subject line, provide relevant documents or links, and always include a call to action (such as scheduling a meeting or a call). Follow up regularly if you don’t receive a response. However, avoid being overly persistent.

You can get in touch with any reliable database provider that provides customized data solutions. For instance, DataCaptive offers lists that are tailored to your needs, including your location preferences.

While most database providers, such as DataCaptive, primarily cater to the US, they also have databases from various countries across the globe. You can contact a trustworthy data solutions provider and ask for a list of investors in your area of operation or practice.

Get a Sample Email List

Show Some Love!

Subscribe to Our Newsletter

Stay updated with the latest tips and strategies. Get additional discounts and alerts on offers.

Related Articles

Subscribe to Newsletter

Stay up to date with the latest marketing, sales, and service tips and news.

Share your requirements, and we’ll provide a tailored list to maximize your impact with the right contacts!

FILL IN YOUR DETAILS TO REQUEST A CALLBACK

You may also be interested in:

Access accurate personal emails and direct numbers for improved outreach.